A lot of people do not review their estate plans since this can be a daunting task. Others put this off as they don’t want to think or talk about death. If you already have an estate plan in place, congratulations! Many people still do not have one. But if you have decided to make a plan, it’s important to be aware of the common mistakes others make, so you can avoid them. Also, you must have an estate planning attorney in Ridgeland on your side when drafting a plan. Your attorney can point out matters that can lead to issues in the future. These include the following:

Not Updating Your Plan

Over the years, your family and life situations can change. You might welcome a new member to your family, lose one, or remove beneficiaries. The needs of your family have changed since you first made your plan. Similarly, your executor may have died or may not be able to serve anymore. Because of these reasons, you must need to have new executors. Whenever there are changes to your circumstances, it is a good idea to update your estate plan.

Major Components are Missing in Your Plan

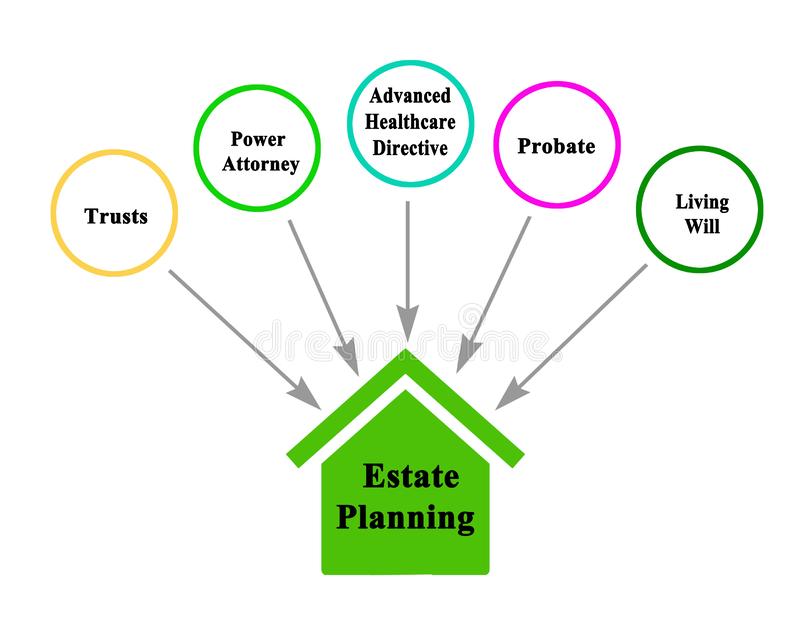

Although you have created a plan already, it may still lack key components to protect the people you love when you die. You should at least have a last will and testament, a health care directive, and a financial power of attorney. A knowledgeable attorney should review these legal documents within the last five years and right after any major life event like birth or death of a child, marriage, divorce, asset increase or decrease, and inheritance acquisition. Such life changes will require a new level of protection.

Keeping Up with Tax Law Changes

If you own significant wealth, ensure your estate plan benefits from the unique planning opportunities the current law provides. An outdated plan structure can put your family at a disadvantage through inevitable taxation. A great lawyer who understands your situation must review your estate planning documents and make important adjustments.

Moving without Updating Your Plan

Did you know that every state has its own estate planning law? Thus, if you move to another state, you should have an attorney review and revise your estate planning documents. Ensure these documents comply with state laws. Also, this applies to advance directives because they may no longer be valid in your new state.